Advertisement

-

Published Date

March 8, 2023This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

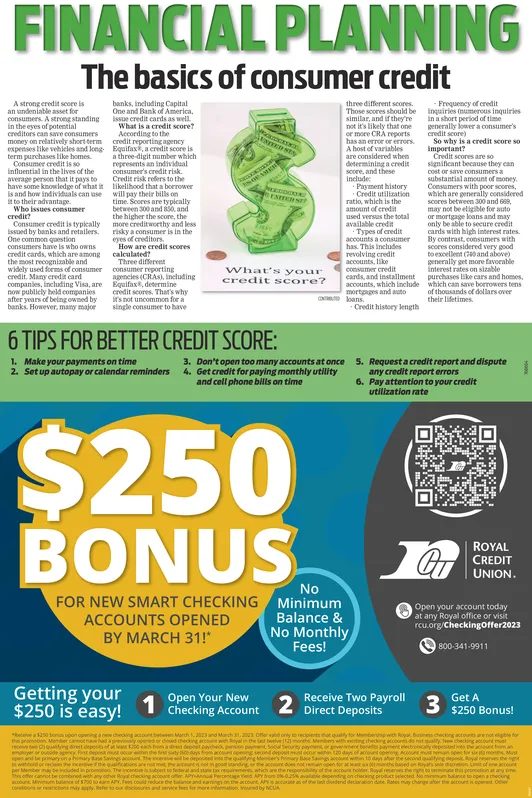

FINANCIAL PLANNING The basics of consumer credit banks, including Capital One and Bank of America. issue credit cards as well. What is a credit score? According to the credit reporting agency Equifax, a credit score is a three-digit number which represents an individual consumer's credit risk. Credit risk refers to the likelihood that a borrower will pay their bills on time. Scores are typically between 300 and 850, and the higher the score, the more creditworthy and less risky a consumer is in the eyes of creditors. How are credit scores calculated? Three different consumer reporting agencies (CRAS), including Equifax, determine As A strong credit score is an undeniable asset for consumers. A strong standing in the eyes of potential creditors can save consumers money on relatively short term expenses like vehicles and long term purchases like homes. Consumer credit is so influential in the lives of the average person that it pays to have some knowledge of what it is and how individuals can use it to their advantage. Who issues consumer credit? Consumer credit is typically issued by banks and retailers. One common question consumers have is who owns credit cards, which are among the most recognizable and widely used forms of consumer credit. Many credit card companies, including Visa, are now publicly held companies after years of being owned by banks. However, many major credit scores. That's why it's not uncommon for a single consumer to have Getting your $250 is easy! 1 Eest 6 TIPS FOR BETTER CREDIT SCORE: 1. Make your payments on time 2. Set up autopay or calendar reminders COCKE EXFTER SEP What's your credit score? $250 BONUS FOR NEW SMART CHECKING ACCOUNTS OPENED BY MARCH 31!* acations aren time, the per Member This offer cannot be combined any other Royal checking out Mimbalance of S 360 APY, Fees could con mayor Open Your New Checking Account three different scores. Those scores should be similar, and if they're not it's likely that one or more CRA reports has an error or errors. A host of variables are considered when determining a credit score, and these include: Payment history Credit utilization ratio, which is the amount of credit used versus the total available credit Types of credit accounts a consumer has. This includes revolving credit accounts, like consumer credit cards, and installment accounts, which include mortgages and auto Credit history length 3. Don't open too many accounts at once 4. Get credit for paying monthly utility and cell phone bills on time coloans. No Minimum Balance & No Monthly Fees! -Frequency of credit inquiries (numerous inquiries in a short period of time generally lower a consumer's credit score) So why is a credit score so important? Credit scores are so significant because they can cost o st or save consumers a substantial amount of money. Consumers with poor scores, which are generally considered scores between 300 and 669, may not be eligible for auto or mortgage loans and may only be able to secure credit cards with high interest rates. By contrast, consumers with scores considered very good to excellent (700 and above) generally get more favorable interest rates on sizable purchases like cars and homes, which can save borrowers tens of thousands of dollars over their lifetimes. 5. Request a credit report and dispute any credit report errors 6. Pay attention to your credit utilization rate Receive Two Payroll Direct Deposits ROYAL CREDIT UNION. 3 GT Open your account today at any Royal office or visit rcu.org/CheckingOffer2023 800-341-9911 2 $250 supon opening a new checking account between March 1, 3 and March 31, 2003 er open at primary Savings and The only to recipes that quality for Membership with Royal Butschecking accounts are not eligible for the pramon Member samot have at a printy opened or cond thecking account with Royal in the last tvive 12 months Members withing checking accounts do not alty New checking account mal requying to each ad depest payche, pen pant Social Security payment or goverment bene payment electronically deposited the account from an employer or outside agency Fost deposit must or within the first sety days from account opening second deptocour en 120 days of acces opening Account on remain open for months t deposited in quality mary Bee Saing one when 10 days after Mon quality depo reserves the right count not in good sondige does not Nonthshed on sole dion L gurenemo console. Royal reserves the right i anyte counser Annual Percentage old Pro -0.25% vapending checking product selected Mominum balance to open a checking tance and earnings on the account, APY diudend declaration date Rates may change after the account opeed. Other and services for more intonation by NCUA to whold or Get A $250 Bonus! 1 FINANCIAL PLANNING The basics of consumer credit banks , including Capital One and Bank of America . issue credit cards as well . What is a credit score ? According to the credit reporting agency Equifax , a credit score is a three - digit number which represents an individual consumer's credit risk . Credit risk refers to the likelihood that a borrower will pay their bills on time . Scores are typically between 300 and 850 , and the higher the score , the more creditworthy and less risky a consumer is in the eyes of creditors . How are credit scores calculated ? Three different consumer reporting agencies ( CRAS ) , including Equifax , determine As A strong credit score is an undeniable asset for consumers . A strong standing in the eyes of potential creditors can save consumers money on relatively short term expenses like vehicles and long term purchases like homes . Consumer credit is so influential in the lives of the average person that it pays to have some knowledge of what it is and how individuals can use it to their advantage . Who issues consumer credit ? Consumer credit is typically issued by banks and retailers . One common question consumers have is who owns credit cards , which are among the most recognizable and widely used forms of consumer credit . Many credit card companies , including Visa , are now publicly held companies after years of being owned by banks . However , many major credit scores . That's why it's not uncommon for a single consumer to have Getting your $ 250 is easy ! 1 Eest 6 TIPS FOR BETTER CREDIT SCORE : 1. Make your payments on time 2. Set up autopay or calendar reminders COCKE EXFTER SEP What's your credit score ? $ 250 BONUS FOR NEW SMART CHECKING ACCOUNTS OPENED BY MARCH 31 ! * acations aren time , the per Member This offer cannot be combined any other Royal checking out Mimbalance of S 360 APY , Fees could con mayor Open Your New Checking Account three different scores . Those scores should be similar , and if they're not it's likely that one or more CRA reports has an error or errors . A host of variables are considered when determining a credit score , and these include : Payment history Credit utilization ratio , which is the amount of credit used versus the total available credit Types of credit accounts a consumer has . This includes revolving credit accounts , like consumer credit cards , and installment accounts , which include mortgages and auto Credit history length 3. Don't open too many accounts at once 4. Get credit for paying monthly utility and cell phone bills on time coloans . No Minimum Balance & No Monthly Fees ! -Frequency of credit inquiries ( numerous inquiries in a short period of time generally lower a consumer's credit score ) So why is a credit score so important ? Credit scores are so significant because they can cost o st or save consumers a substantial amount of money . Consumers with poor scores , which are generally considered scores between 300 and 669 , may not be eligible for auto or mortgage loans and may only be able to secure credit cards with high interest rates . By contrast , consumers with scores considered very good to excellent ( 700 and above ) generally get more favorable interest rates on sizable purchases like cars and homes , which can save borrowers tens of thousands of dollars over their lifetimes . 5. Request a credit report and dispute any credit report errors 6. Pay attention to your credit utilization rate Receive Two Payroll Direct Deposits ROYAL CREDIT UNION . 3 GT Open your account today at any Royal office or visit rcu.org/CheckingOffer2023 800-341-9911 2 $ 250 supon opening a new checking account between March 1 , 3 and March 31 , 2003 er open at primary Savings and The only to recipes that quality for Membership with Royal Butschecking accounts are not eligible for the pramon Member samot have at a printy opened or cond thecking account with Royal in the last tvive 12 months Members withing checking accounts do not alty New checking account mal requying to each ad depest payche , pen pant Social Security payment or goverment bene payment electronically deposited the account from an employer or outside agency Fost deposit must or within the first sety days from account opening second deptocour en 120 days of acces opening Account on remain open for months t deposited in quality mary Bee Saing one when 10 days after Mon quality depo reserves the right count not in good sondige does not Nonthshed on sole dion L gurenemo console . Royal reserves the right i anyte counser Annual Percentage old Pro -0.25 % vapending checking product selected Mominum balance to open a checking tance and earnings on the account , APY diudend declaration date Rates may change after the account opeed . Other and services for more intonation by NCUA to whold or Get A $ 250 Bonus ! 1